Decoding luxury fashion: the 2025 UK consumer edit

Luxury fashion has long been associated with aspiration, status, and self-expression. But in 2025, it is increasingly defined by something more measured: intention. Today’s luxury consumers are not simply buying more – they are making more considered decisions about what earns a place in their wardrobe.

Across the UK, shoppers are placing greater emphasis on versatility and longevity, investing in pieces that can be worn across multiple occasions and settings. This suggests a more considered approach to value, where quality, adaptability, and design coexist alongside emotional connection and personal expression.

To understand how these attitudes are evolving and what the future holds, FARFETCH surveyed consumers to explore how modern shoppers perceive, purchase, and invest in luxury womenswear, menswear, and accessories. The findings reveal a new set of rules shaping luxury wardrobes – one where versatility, sustainability, and thoughtful consumption take precedence over volume and impulse.

Luxury fashion in 2025: A snapshot

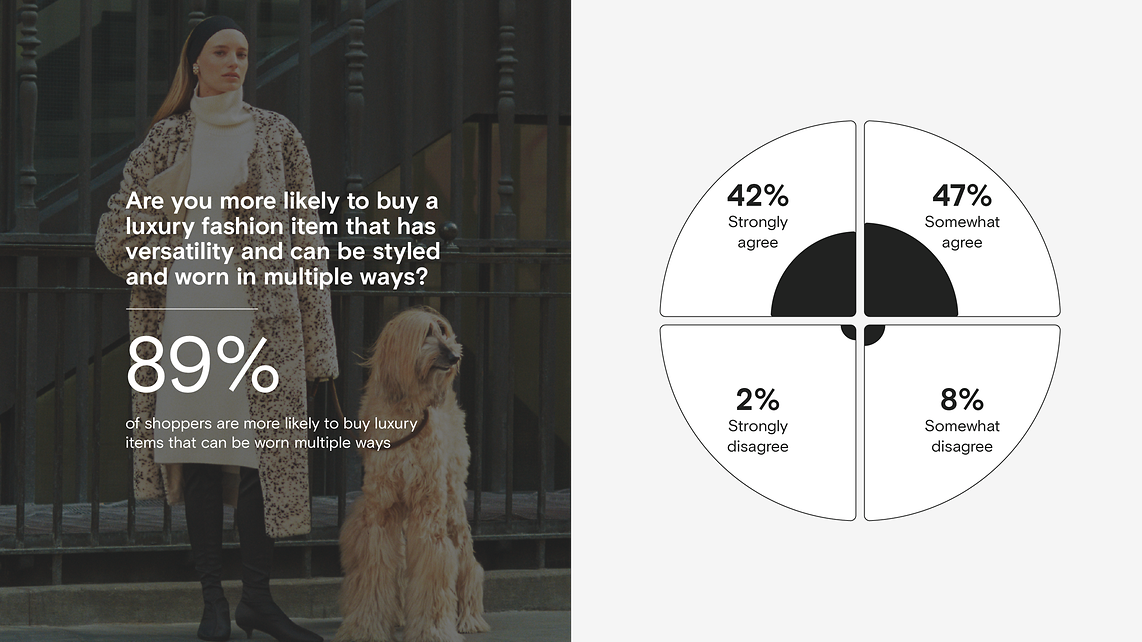

- 89% of luxury shoppers prioritise versatility when buying high-end fashion, favouring pieces that can be styled and worn in multiple ways.

- 71% say sustainability influences their luxury purchasing decisions, particularly when framed around investing in fewer, higher-quality items.

- Nearly half of consumers (47%) view luxury fashion as a financial investment, highlighting a shift toward more considered, value-driven buying.

- Most shoppers surveyed own just 2-5 high-end fashion items, indicating smaller, more curated wardrobes rather than large collections.

- Under-35s are the most investment-driven luxury buyers, with younger shoppers more likely to view luxury as an asset and spend at higher price points.

The modern approach to luxury fashion

Luxury fashion is becoming more integrated into everyday wardrobes, driven by a growing expectation that high-end purchases should deliver both style and practicality. Rather than buying for singular moments, consumers are increasingly prioritising pieces that justify their cost through repeat wear, flexibility, and timeless practicality.

This shift is reshaping what people buy, how often they wear it, and which categories dominate modern luxury wardrobes.

89% of shoppers are more likely to buy luxury items that can be worn multiple ways

Versatility has become a defining factor in luxury purchasing decisions. With nearly nine in ten (89%) shoppers actively seeking adaptable designs, consumers are placing greater emphasis on how often and in how many ways an item can be worn. This highlights the importance shoppers place on adaptability, with designs that work across different occasions, seasons, and settings, without compromising on design or quality.

Within these responses, a small gender gap emerges. Women are more likely to place a strong emphasis on versatility, with 45% strongly agreeing that it influences their luxury purchases, compared with 39% of men.

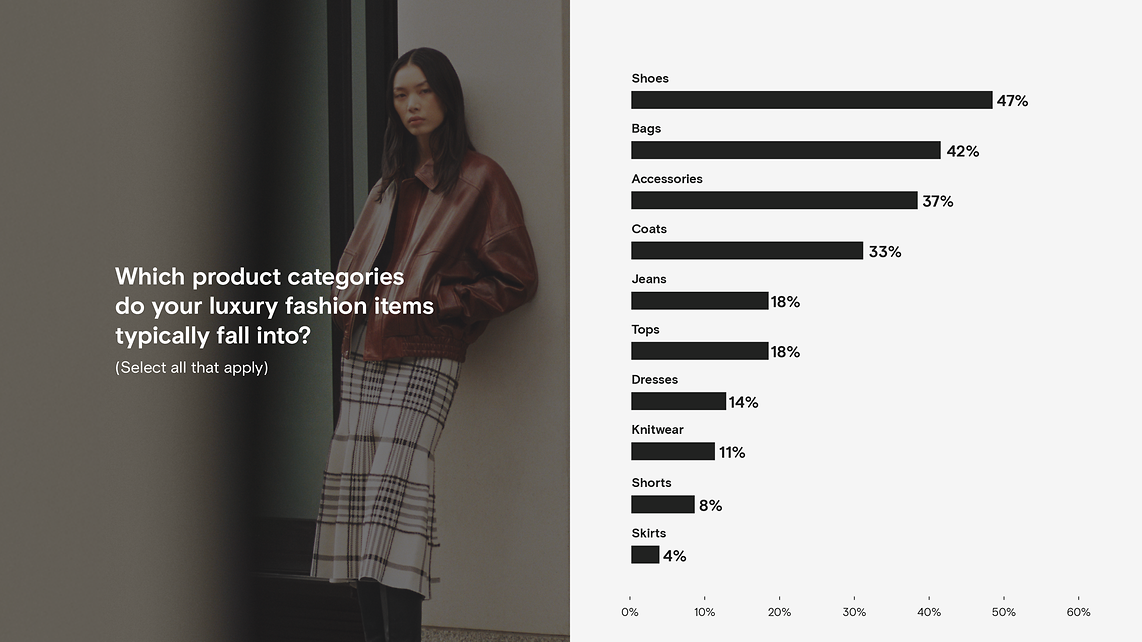

Shoes, bags, and accessories dominate luxury wardrobes

The most commonly owned luxury items are those that deliver both visibility and practicality. Shoes (47%), bags (42%), and accessories (37%) sit at the centre of luxury wardrobes because they can elevate everyday outfits while remaining functional. These categories also lend themselves to longevity, making them natural choices for consumers building smaller, more intentional collections.

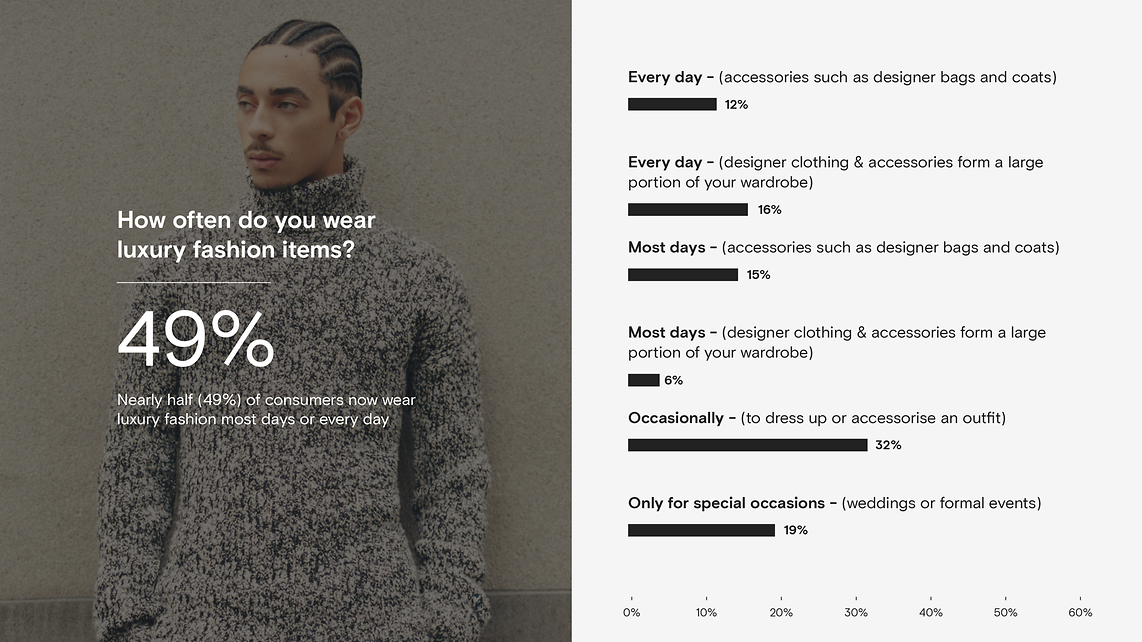

Nearly half (49%) of consumers now wear luxury fashion most days or every day

Luxury is no longer reserved solely for special occasions – it has become a staple medium of self-expression that people use on a daily basis to shape their identity.

A significant portion (49%) of consumers incorporate luxury pieces into their regular wardrobe rotation, particularly through accessories and outerwear (evidenced by the most popular luxury items revealed above). This pattern suggests that luxury fashion is increasingly viewed as something to be worn and experienced, rather than preserved, thereby reinforcing the importance of durability, comfort, and repeatability in high-end design.

Shopper psychology: Inside the mind of the modern luxury shopper

Luxury purchasing decisions are shaped by a combination of practical considerations and personal meaning. While quality remains the foundation of luxury appeal, shoppers are increasingly guided by how well a piece reflects their identity, justifies its value, and fits into a more intentional approach to consumption.

The data highlights a nuanced hierarchy of motivations, with craftsmanship leading the way, supported by self-expression, investment thinking, and status.

Quality and craftsmanship are the top motivations for luxury purchases (59%)

Quality and craftsmanship sit at the core of modern luxury buying decisions. With nearly six in ten shoppers citing this as a key motivation, consumers are placing greater importance on how an item is made, how long it will last and whether it justifies its price over time. This reinforces the idea that luxury is increasingly assessed by durability and construction, rather than just brand recognition.

Interestingly, this priority becomes more pronounced with age, rising to 66% among consumers aged 55-64 and 65% among those aged 65 and above, compared with 52% of those aged 18-24. This suggests that older shoppers are particularly focused on durability, materials, and construction, reinforcing the notion that luxury is a long-term investment rather than a trend-driven purchase.

Four in ten buyers say luxury fashion helps express identity and personal style

Beyond quality, luxury continues to play a significant role in personal expression. For 40% of shoppers, luxury fashion serves as a means of expressing identity and individual style, underscoring its enduring cultural significance. This suggests that while purchasing habits may be more restrained, the symbolic and creative value of luxury remains central to why people buy into high-end fashion.

This motivation is strongest among younger shoppers, cited by 49% of 18-24s and 48% of 25-34s, before gradually declining with age. So, while older generations prioritise craftsmanship, younger audiences continue to see luxury as a vehicle for self-expression and personal branding.

Men are more likely to buy luxury fashion for status and investment, while women prioritise emotion and sustainability

Gender differences further shape luxury psychology. Men are more likely to cite status (28% vs 18%) and investment (27% vs 23%) as motivations, indicating a stronger emphasis on prestige and long-term value.

Women, by contrast, tend to frame luxury in terms of emotional and ethical considerations. Nearly three-quarters (74%) of women say sustainability influences their luxury purchasing decisions, compared with 66% of men. Additionally, women are more likely to view luxury as an emotional purchase (56% vs 50%).

Together, these patterns suggest that while both groups value quality, men tend to approach luxury more pragmatically, while women place greater emphasis on meaning, longevity, and responsible consumption.

Investing in luxury: Do consumers seek financial assets or make emotional purchases?

Luxury fashion occupies a dual role in modern consumer behaviour. For some, it represents long-term value and financial consideration; for others, it is tied to emotion, memory and personal reward. The data shows that how luxury is framed depends strongly on age, life stage, and spending power.

Luxury is split between financial and emotional value (47% vs 53%)

Attitudes towards luxury fashion are almost evenly divided. 47% of consumers view luxury as a financial investment, while 53% see it primarily as an emotional purchase. This close split highlights that luxury is rarely evaluated on a single dimension, with practical and personal considerations often sitting alongside one another in purchasing decisions.

Nearly six in ten under-35s see luxury fashion as a financial investment

Younger shoppers are significantly more likely to approach luxury fashion through an investment lens. Over half (57%) of consumers under the age of 35 view luxury as a financial investment, reflecting a more strategic mindset in which resale value, longevity, and brand equity are increasingly considered at the point of purchase.

This suggests that for younger buyers, luxury is not just about ownership, but about making purchases that retain relevance and value over time.

Over two-thirds of older shoppers are likely to view luxury fashion as an emotional purchase

Emotional value becomes increasingly important with age. On average, shoppers aged 55 and over are approximately 27 percentage points more likely to view luxury fashion as an emotional purchase compared to those under 35.

Among consumers aged 55-64, 67% associate luxury with emotional value, rising to 71% among those aged 65 and above, compared with an average of 42.5% among those under 35. This suggests a stronger emotional connection to luxury among older shoppers, often rooted in personal history, milestones, and long-term preferences.

Four in ten consumers are willing to spend £2,000+ on a single luxury item

Spending appetite at the top end of the market is more widespread than often assumed. Four in ten consumers say they would be willing to spend £2,000 or more on a single luxury fashion transaction, with a significant proportion comfortable at significantly higher price points.

This indicates that high-value purchases are not always limited to a niche group of ultra-high-net-worth shoppers, but form part of mainstream luxury consumption, particularly among buyers who view luxury as an investment and prioritise longevity, quality, and repeat wear.

Men are the bigger spenders, according to our data, though, with 44% of men saying they’d be willing to spend upwards of £2,000 on a single purchase, compared to 37% of women.

Ownership and usage: What does the average luxury wardrobe look like?

Despite perceptions of excess, most luxury wardrobes are relatively small and carefully curated. Ownership levels remain modest, and usage patterns suggest that high-end fashion is worn selectively, with certain categories playing a more prominent role in everyday dressing.